Top 5 Best Shares In India

Are you looking for the Best Shares to invest in India? In this article, we will explore the top 5 Best Shares in India for investment. By analyzing their performance, growth prospects, and market trends, we can identify promising opportunities to maximize your investment potential.

- Reliance Industries Limited (RIL)

- Tata Consultancy Services Limited (TCS)

- Housing Development Finance Corporation Limited (HDFC)

- Infosys Limited (INFY)

- State Bank of India (SBI)

Reliance Industries Limited (RIL)

As of my knowledge cutoff in June 2023, here are a few notable news updates regarding Reliance Industries Limited (RIL).

Please note that the information I provided may not reflect the latest developments. It is essential to refer to reliable financial news sources for the most up-to-date updates.

- Digital Transformation: Reliance Industries has been focusing on its digital transformation initiatives, particularly through its subsidiary, Jio Platforms. RIL has made significant investments in areas such as telecommunications, e-commerce, digital services, and technology.

- Partnership with Google: In July 2020, Google announced an investment of $4.5 billion in Jio Platforms for a 7.73% stake. This partnership aims to develop affordable smartphones and expand digital connectivity in India.

- Reliance Industries conducted stake sales in subsidiaries like Jio Platforms and Reliance Retail, attracting investments from global investors such as Facebook, Google, and Silver Lake. These fundraising activities helped RIL reduce debt and strengthen its balance sheet.

Please note that the information provided may not reflect the latest developments. Refer to reliable financial news sources for the most up-to-date updates. To stay updated with the latest news regarding RIL

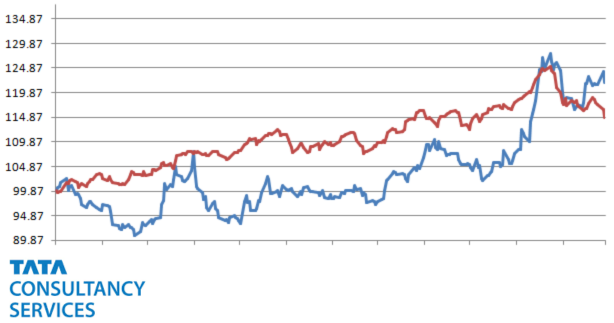

Tata Consultancy Services Limited

As of my knowledge cutoff in September 2023, here are some notable news updates regarding Tata Consultancy Services Limited (TCS). Information may not be current; refer to reliable financial news sources for updates.

- Strong Financial Performance: TCS has consistently delivered strong financial performance over the years, with consistent revenue growth and profitability. It is one of the largest IT Services Companies in India and globally.

- TCS focuses on digital transformation services and emerging technologies like cloud computing, AI, data analytics, and IoT.

- The company has been helping its clients adapt to the digital age and leverage technology to drive growth and efficiency.

- Expansion of Global Operations: TCS has a significant presence in several countries around the world and has been expanding its operations further. It has been securing new contracts and partnerships globally, strengthening its position as a leading IT Services Provider.

- Employee Base and Talent Development: TCS is known for its large and highly skilled employee base.

- The company invests in talent development through training and upskilling programs to keep its workforce updated with the latest technological advancements.

To stay updated with the latest news regarding TCS, I recommend referring to reliable financial news sources or visiting the official website of Tata Consultancy Services for official announcements.

Housing Development Finance Corporation Limited (HDFC)

As of my knowledge cutoff in June 2023, here are some notable news updates regarding Housing Development Finance Corporation Limited (HDFC).

Housing Development Finance Corporation Limited (HDFC) is among the best shares in India. As a leading provider of housing finance, HDFC has a strong foothold in the market. Its consistent financial performance, diverse range of financial services, and emphasis on digital initiatives make it an appealing choice for investors. With its focus on mortgage lending and commitment to customer satisfaction, HDFC offers a promising investment opportunity in the Indian stock market.

- Mortgage Lending: HDFC is one of the largest providers of housing finance in India. The company has been actively involved in mortgage lending, providing home loans to individuals and families across the country.

- Financial Performance: HDFC has consistently demonstrated strong financial performance over the years. The company has reported steady growth in its loan book and net interest income, along with healthy asset quality.

- Diversification: HDFC has expanded its operations beyond mortgage lending and ventured into other financial services. The company offers a range of financial products and services, including insurance, banking, asset management, and real estate advisory services.

- Digital Initiatives: HDFC has been embracing digital transformation and investing in technology to enhance its customer experience and streamline its operations. The company has introduced various digital platforms and services to facilitate convenient and efficient banking and financial transactions.

To stay updated on HDFC news, refer to reliable financial news sources or HDFC’s official website for announcements.

Infosys Limited (INFY)

As of my knowledge cutoff in September 2023, here are some notable news updates regarding Infosys Limited (INFY). Please note that this information may not reflect the most recent developments, and it’s important to refer to reliable financial news sources for the latest updates:

When it comes to the best shares in India, Infosys Limited (INFY) is a top contender.

Infosys is well-positioned in the modern business landscape with a focus on digital services, innovation, and emerging technologies like AI and cloud computing. Its strong financial performance and commitment to talent development make it an attractive investment option for growth and technological prowess in India.

- Financial Performance: Infosys is one of the largest IT services companies in India. The company has consistently reported strong financial performance, with steady revenue growth and improved profitability. It has a diverse client base and provides a range of IT solutions and services.

- Infosys focuses on digital services and innovation, investing in emerging technologies like AI, cloud computing, data analytics, and automation to drive business growth and assist clients with digital transformation.

- Global Expansion and Partnerships: Infosys has a significant global presence and has been expanding its operations in various countries. The company has been securing partnerships and collaborations with clients, industry leaders, and academic institutions to drive innovation and strengthen its market position.

- Talent Development and Skilling: Infosys places a strong emphasis on talent development and skilling initiatives. The company has various training programs and initiatives to enhance the skills of its workforce, foster innovation, and stay ahead in the fast-changing IT industry.

Stock market is dynamic; refer to reliable financial news sources or Infosys’ official website for latest INFY updates.

State Bank of India (SBI)

As of my knowledge cutoff in June 20243, here are some notable news updates regarding State Bank of India (SBI). Please note that this information may not reflect the most recent developments, and it’s important to refer to reliable financial news sources for the latest updates:

Looking for the best shares in India? Consider investing in State Bank of India (SBI), one of the country’s leading banks.

SBI is a top choice for reliable and profitable investments in India due to its strong presence, robust financial performance, and adherence to regulatory guidelines.

- Financial Performance: State Bank of India is the largest public sector bank in India and has been reporting its financial performance. SBI’s financial results, including its net interest income, profitability, and asset quality, are closely monitored by investors and analysts.

- Digital Transformation: SBI has been actively involved in digital transformation initiatives to enhance customer experience and streamline banking operations. The bank has introduced various digital services and platforms, such as mobile banking, internet banking, and digital payment solutions, to cater to evolving customer needs.

- Government Initiatives: As a public sector bank, SBI plays a crucial role in supporting various government initiatives, such as financial inclusion, social welfare programs, and lending to priority sectors. The bank’s participation in these initiatives and its impact on the economy are often highlighted in the news.

- SBI operates under RBI’s regulatory framework, adhering to various regulations and guidelines.

- News related to changes in regulations or regulatory actions concerning SBI can impact its share price and market sentiment.

Stock market is dynamic; refer to reliable financial news sources or SBI’s official website for latest updates.

Conclusion

For the latest share updates on companies like RIL, TCS, HDFC, SBI, or others, refer to reliable financial news sources, online brokerages, or consult a financial advisor.